The agriculture industry has radically transformed over the past 50 years. Advances in machinery have expanded the scale, speed, and productivity of farm equipment, leading to more efficient cultivation of more land. Seed, irrigation, and fertilizers also have vastly improved, helping farmers increase yields. Now, agriculture is in the early days of yet another revolution, at the heart of which lie data and connectivity. Artificial intelligence, analytics, connected sensors, and other emerging technologies could further increase yields, improve the efficiency of water and other inputs, and build sustainability and resilience across crop cultivation and animal husbandry.

Without a solid connectivity infrastructure, however, none of this is possible. If connectivity is implemented successfully in agriculture, the industry could tack on $500 billion in additional value to the global gross domestic product by 2030, according to our research. This would amount to a 7 to 9 percent improvement from its expected total and would alleviate much of the present pressure on farmers. It is one of just seven sectors that, fueled by advanced connectivity, will contribute $2 trillion to $3 trillion in additional value to global GDP over the next decade, according to research by the McKinsey Center for Advanced Connectivity and the McKinsey Global Institute (MGI).

Demand for food is growing at the same time the supply side faces constraints in land and farming inputs. The world’s population is on track to reach 9.7 billion by 2050,1 requiring a corresponding 70 percent increase in calories available for consumption, even as the cost of the inputs needed to generate those calories is rising. By 2030, the water supply will fall 40 percent short of meeting global water needs, and rising energy, labor, and nutrient costs are already pressuring profit margins. About one-quarter of arable land is degraded and needs significant restoration before it can again sustain crops at scale.4 And then there are increasing environmental pressures, such as climate change and the economic impact of catastrophic weather events, and social pressures, including the push for more ethical and sustainable farm practices, such as higher standards for farm-animal welfare and reduced use of chemicals and water.

Demand for food is growing at the same time the supply side faces constraints in land and farming inputs.

To address these forces poised to further roil the industry, agriculture must embrace a digital transformation enabled by connectivity. Yet agriculture remains less digitized compared with many other industries globally. Past advances were mostly mechanical, in the form of more powerful and efficient machinery, and genetic, in the form of more productive seed and fertilizers. Now much more sophisticated, digital tools are needed to deliver the next productivity leap. Some already exist to help farmers more efficiently and sustainably use resources, while more advanced ones are in development. These new technologies can upgrade decision making, allowing better risk and variability management to optimize yields and improve economics. Deployed in animal husbandry, they can enhance the well-being of livestock, addressing the growing concerns over animal welfare.

But the industry confronts two significant obstacles. Some regions lack the necessary connectivity infrastructure, making development of it paramount. In regions that already have a connectivity infrastructure, farms have been slow to deploy digital tools because their impact has not been sufficiently proven.

The COVID-19 crisis has further intensified other challenges agriculture faces in five areas: efficiency, resilience, digitization, agility, and sustainability. Lower sales volumes have pressured margins, exacerbating the need for farmers to contain costs further. Gridlocked global supply chains have highlighted the importance of having more local providers, which could increase the resilience of smaller farms. In this global pandemic, heavy reliance on manual labor has further affected farms whose workforces face mobility restrictions. Additionally, significant environmental benefits from decreased travel and consumption during the crisis are likely to drive a desire for more local, sustainable sourcing, requiring producers to adjust long-standing practices. In short, the crisis has accentuated the necessity of more widespread digitization and automation, while suddenly shifting demand and sales channels have underscored the value of agile adaptation.

Current connectivity in agriculture

In recent years, many farmers have begun to consult data about essential variables like soil, crops, livestock, and weather. Yet few if any have had access to advanced digital tools that would help to turn these data into valuable, actionable insights. In less-developed regions, almost all farmwork is manual, involving little or no advanced connectivity or equipment.

Even in the United States, a pioneer country in connectivity, only about one-quarter of farms currently use any connected equipment or devices to access data, and that technology isn’t exactly state-of-the-art, running on 2G or 3G networks that telcos plan to dismantle or on very low-band IoT networks that are complicated and expensive to set up. In either case, those networks can support only a limited number of devices and lack the performance for real-time data transfer, which is essential to unlock the value of more advanced and complex use cases.

Nonetheless, current IoT technologies running on 3G and 4G cellular networks are in many cases sufficient to enable simpler use cases, such as advanced monitoring of crops and livestock. In the past, however, the cost of hardware was high, so the business case for implementing IoT in farming did not hold up. Today, device and hardware costs are dropping rapidly, and several providers now offer solutions at a price we believe will deliver a return in the first year of investment.

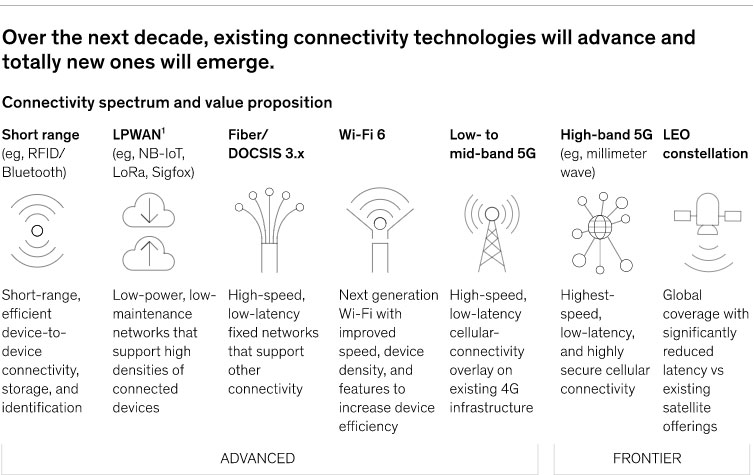

These simpler tools are not enough, though, to unlock all the potential value that connectivity holds for agriculture. To attain that, the industry must make full use of digital applications and analytics, which will require low latency, high bandwidth, high resiliency, and support for a density of devices offered by advanced and frontier connectivity technologies like LPWAN, 5G, and LEO satellites.